Overview

The expected benefits

Together, let’s harness the full potential of the European payment account information opening.

This AISP PSD2 API product allows you to securely access transaction data for customer payment accounts from all institutions within the Banques Populaires network.

Secure Data Access

Access customers' payment account information through a secure and regulatory-compliant device.

Value Creation

Enhance your offerings and products to better serve your clients through innovative use cases.

The connection is made through a secure device compliant with European regulatory requirements. By accessing this account information service, your customers will be able to view their payment account information within your environment: account list, balances, transactions (date, description, and amount), etc.

You will thus be able to enhance the added value of your products/services to serve your clients through innovative use cases: account consolidation, accounting reconciliation, customer knowledge enrichment, budget analysis and forecasting, etc.

The different possible use cases

Together, let's create value for our shared clients.

Consolidation

Allow your clients to aggregate their payment accounts to have a consolidated and real-time view of their transactions.

Accounting Reconciliation

Enable your corporate clients to reconcile their invoices and business expenses with their payment transactions.

Customer Insights

Understand and learn from the payment behavior of your individual or corporate clients.

Business Management

Leverage customer payment data to build high-value management dashboards.

How to access the product ?

To access the Account Information Services API, developers and businesses must follow the steps below.

Contact

Get in touch with the product managers.

Access

Enroll directly through the dedicated process (regulated entities).

Integration & Testing

Integrate our service into your solution and share your use cases with us to help ensure the quality of our offering.

Go Live !

Documentation

Guides

Data aggregation

A multi-bank customer wants access to all his data so that he can have a consolidated view.

Via this “Account Information Services” API made available by the account holders, you can request access in real time to any or all of the data that the customer has authorised WITHOUT asking them for their online login details.

You can retrieve this customer’s current accounts from the bank where they are located. For these current accounts, depending on the customer’s consent that you have obtained and sent to us, you can retrieve their balances, transactions, authorised overdraft, associated deferred debit cards, outstandings and invoices for these deferred debit cards.

You can access this API in batch mode in order to prepare the output to the customer on your application (up to a maximum of 4 times per day). At the request of the customer connected to their application, you can refresh this data (without limitation).

This API can only be used if you have obtained the role of Account Information Service Provider (“TPP AISP”), this prerequisite being described in the “Eligibility” section.

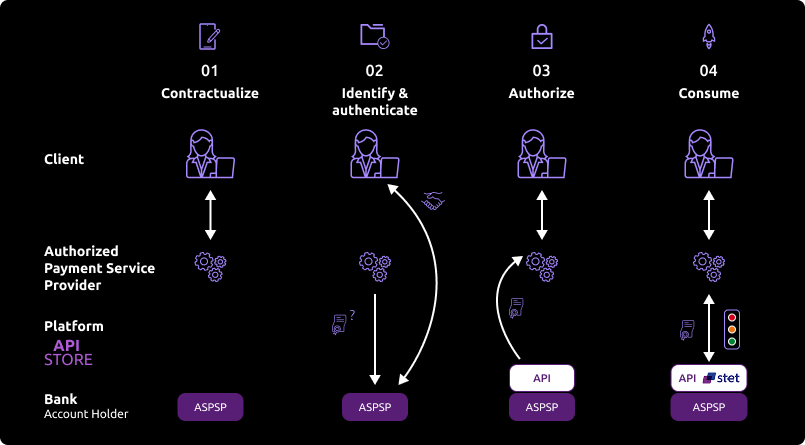

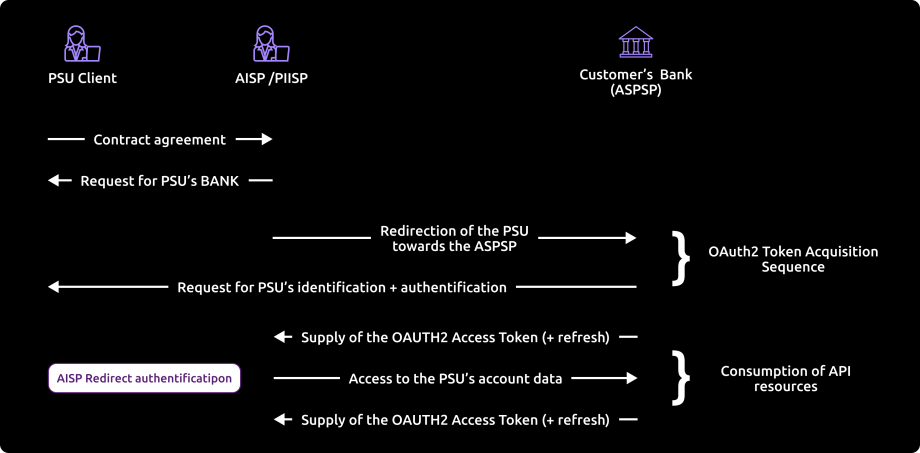

The overall process is as follows:

The customer wants to use your services to consolidate information from one or more payment accounts held with banks, one of which is the customer’s bank. He will therefore indicate this bank to you through your interfaces.

During this first exchange, you will request an authorisation token (and a refresh token). The basic principle is that, as an AISP TPP, you must obtain these tokens BEFORE consuming API resources. This token is generated by the account holder (ASPSP) AFTER identifying and authenticating the client.

As account holder :

- we will check your certificates and approvals

- and via the redirection game, we will identify and strongly authenticate the client in order to generate the access token

If authorisation is granted by the customer, you will then be able to retrieve the OAuth2 tokens via secure exchanges with the 89C3 API platform (see “Use cases” > “Get your access token”).

By presenting this authorisation token, you can then consume the resources of the “Account Information Services” API in order to :

- request a list of eligible accounts

- send us customer consent

- secure access to data to which access has been authorised (see “Consume the API”).

At the end of the 180-day regulatory period, this process will have to be repeated (see “Use cases” > “Refresh your access token”).

NB: the ASPSP account manager may refuse you access for various justified reasons (API not compliant, account blocked in the meantime, etc.).

Consume the API

The description of the services offered below is purely functional. The technical aspects are listed in the “Use cases” sections, which are more detailed.

You should also be familiar with PSD2 terminology and the abbreviations used. You can also use the frequently asked questions (FAQ).

Introduction – mixed AISP consent vs. full AISP consent

The STET standard offers two consent management modes: full AISP consent and mixed AISP consent. Only the mixed AISP consent mode has been developed.

The kinematics below describe how it is implemented, and in particular the use of the PUT /consents method, which enables you to transmit the accounts granted by the customer.

It summarises the sequence of calls to the various methods of the AISP API, from token recovery to the recovery of current accounts and deferred debit cards and their balances / transactions / authorised overdraft / account owners and outstandings / invoices respectively, as well as the recovery of the customer’s identity.

Prerequisites

As a TPP, you must be accredited by the Autorité de contrôle prudentiel et de résolution (ACPR) for the role of account aggregator (“AISP”).

To access the "Account Information Services" API, you need to retrieve an OAuth2 access token issued by the customer’s bank by querying it with your credentials. This token is valid for 180 days.

You and the customer’s bank must authenticate each other by exchanging Eidas QWAC certificates.

You then present your OAuth2 access token to use the "Account Information Services" API.

Aggregating data

Use of the "Account Information Services" API :

The AISP asks the customer (PSU) which bank(s) he wishes to consult his accounts from.

The authentication method supported by the bank is REDIRECT mode:

Access authorisation as an AISP given to you by the connected client – recovery of the initial access token valid for 180 days and the refresh token

- The customer is redirected to an identification screen proposed by their bank, where they enter their remote banking identifier. If the AISP provides the customer’s remote banking identifier in its request, the next stage is triggered directly.

- The customer is redirected to a strong authentication screen offered by their bank to validate their identity. The kinematics of this stage depend on the strong authentication method made available to the customer by the bank (SMS OTP, secur’pass, etc.). It also depends on the customer’s equipment running the AISP APP used by the customer (PC or mobile/tablet).

- The customer is redirected to the AISP APP. When requesting token recovery, the AISP provides a call back URL: this will be called by the bank.

First access to retrieve the customer’s list of current accounts

You retrieve the list of the client’s sight accounts via an initial access to the GET /accounts method by providing your access token for this client (see the “Get the list of accounts” use case).

You do not have access to the following information:

- current account balances

- URIs to the

GET /accounts/transactionsmethod - URIs to the

GETmethod/accounts/transactions/details=>this service is not available - URIs to the

GET /accounts/balancesmethod - URIs to the

GET /accounts/overdraftsmethod - URIs to

GET /accounts/owners - URIs to the

GET /end-user-identitymethod - the URI to the

GET /trustedBeneficiaries method=>this service is not available

As long as you have not transmitted the accounts granted by the customer using the PUT /consents method :

- you can still retrieve the list of the client’s sight accounts using the

GET /accountsmethod, but you won’t have any more information than when you first accessed them using this method - if you try to use the

GET /accounts/transactionsmethod, the request will be rejected - if you try to use the

GET /accounts/transactions/detailsmethod, the request will be rejected=> this service is not available for Banques Populaires: HTTP error code 501. - if you try to use the

GET /accounts/balancesmethod, the request will be rejected - if you try to use the

GET /accounts/overdraftsmethod, the request will be rejected. - if you try to use the

GET /accounts/ownersmethod, the request will be rejected - if you try to use the

GET /accounts/end-user-identitymethod, the request will be rejected - if you try to use the

GET /trustedBeneficiariesmethod, the request will be rejected > this service is not available for Banques Populaires: HTTP error code 501.

The customer selects the accounts to which he agrees to give you access on your APP

You ask the customer to select the current accounts and the possible operations on their accounts (balance recovery, transaction recovery, overdraft authorisation recovery, etc.).

Transmission of consent

You send us the list of current accounts that the customer has consented to via the PUT /consents method by providing your access token for this customer (see “Send the list of accounts” use case). The code HTTP 201 : created is returned.

You specify the list of current accounts (IBAN) for which the customer has agreed to transmit balances and/or transactions and/or authorised overdrafts and/or account holders.

You specify whether the customer has consented to the recovery of trusted beneficiaries and to the recovery of their first and last names.

If you have already transmitted the accounts consented to via the PUT /consents method, and the customer subsequently changes their consent, you will transmit the new list of accounts consented to via the PUT /consents method, which will have the effect of cancelling and replacing the previous consent.

If you send an empty list of authorised current accounts for balances and transactions, and set the psuIdentity and trustedBeneficiaries indicators to FALSE, this means that there is no authorised account.

You can send a list of agreed current accounts without first using the GET /accounts method, for example if the customer has sent you the IBANs of their current accounts directly.

Second access to retrieve a customer’s list of current accounts

You retrieve the list of the customer’s sight accounts with their details via a second access to the GET /accounts method by providing your access token for this customer (see the “Get the list of accounts” use case).

You will receive the following information:

- agreed and unagreed current accounts

- deferred debit cards linked to current accounts

- balances on current accounts granted

- URIs to the

GET /accounts/balancesmethod for current accounts granted - URIs to the

GET /accounts/transactionsmethod for current accounts granted - URIs to the

GET /accounts/overdraftsmethod for current accountsgranted - URIs to the

GET /accounts/ownersmethod for current accountsgranted - the URI to the

GET /end-user-identitymethod if the “psuIdentity” flag = TRUE has been passed via the “PUT /consents” method

The following information will not be recovered:

- the URI to the

GET /trustedBeneficiariesmethod > this service is not available. - URIs to the GET

/accounts/transactions/detailsmethod > this service is not available.

Recovery of balances, transactions, name of owner(s) and overdraft authorisations for current accounts, and recovery of outstandings and invoices for deferred debit cards linked to current accounts.

For each authorised current account, you retrieve the account balances via access to the GET /accounts/balances method by providing your access token for this customer (see “Get accounting balances” use case) and using the URI previously communicated by the GET /accounts method for the “_links” “balances”.

For each deferred debit card in an agreed current account, you retrieve the card’s balances by accessing the GET /accounts/balances method, providing your access token for this customer (see “Get accounting balances” use case) and using the URI previously communicated by the GET /accounts method for the “_links” “balances”.

For each sight account granted, you retrieve the account transactions by accessing the GET /accounts/transactions method, providing your access token for this client (see “Get transactions history” use case) and using the URI previously communicated by the GET /accounts method for the “transactions” “_links”.

For each deferred debit card in a consented current account, you retrieve the bills for the account by accessing the GET /accounts/transactions method by providing your access token for this customer (see “Get transactions history” use case) and using the URI previously communiqué par le GET /accounts method for the “transactions” “_links”.

For each authorised current account, you retrieve the account’s authorised overdraft by accessing the GET /accounts/overdrafts method, providing your access token for this customer (see “Obtain authorised overdrafts” use case) and using the URI previously communicated by the GET /accounts method for the “_links” “overdrafts”.

For each authorised current account, you retrieve the account’s owner(s) name by accessing the GET /accounts/owners method, providing your access token for this customer (see “Obtain authorised overdrafts” use case) and using the URI previously communicated by the GET /accounts method for the “_links” “owners”.

If you try to use the GET /accounts/transactions method for a non-consensual current account or for a deferred debit card backed by a non-consensual current account, the request will be rejected.

If you try to use the GET /accounts/balances method for a non-consensual current account or for a deferred debit card backed by a non-consensual current account, the request will be rejected.

If you try to use the GET /accounts/overdrafts method for a non-consensual current account, the request will be rejected.

If you try to use the GET /accounts/owners method for a non-consensual current account, the request will be rejected.

Customer identity recovery

You retrieve the identity of the connected PSU by accessing the GET /end-user-identity method.

Batch refresh of account information

For each customer and for each authorised current account or deferred debit card attached to a current account for that customer, you can refresh the customer’s data (same as steps “Second access to retrieve the list of a customer’s current accounts“, “Retrieve balances, transactions, etc. for authorised current accounts“).

There is a limit of 4 daily batch accesses per PSU for GET /accounts per access page.

There is a limit of 4 daily batch accesses per PSU/account for GET /balances.

There is a limit of 4 daily batch accesses per PSU/account for GET /transactions per access page.

There is a limit of 4 daily batch accesses per PSU/account for GET /overdrafts per access page.

There is a limit of 4 daily batch accesses per PSU/account for GET /owners per access page.

There is a limit of 4 daily batch accesses per PSU/card for GET /balances.

There is a limit of 4 daily batch accesses per PSU/card for GET /transactions per access page.

There is a limit of 4 daily batch accesses per PSU for GET /end-user-identity per access page.

Refreshment of account information at the request of customers connected on their mobile, for the customer and for each of the customer’s consented accounts

For each customer and for each authorised current account or deferred debit card linked to that customer’s current account, the customer can ask to refresh their data from your application (see steps “Second access to retrieve the list of a customer’s current accounts” and “Retrieving balances, transactions, etc. for authorised current accounts“).

Unlike batch access, there is no access limitation in this case.

If the 180-day token has expired, you must request a token refresh for the connected client

- With the client connected to your application, you submit a token refresh request for this client (see “Refresh your access token” use case).

- The customer is redirected to an identification screen proposed by their bank, where they enter their remote banking identifier. If the AISP provides the customer’s remote banking identifier in its request, the next stage is triggered directly.

- The customer is redirected to a strong authentication screen provided by their bank to validate their identity. The kinematics of this stage depend on the strong authentication method made available to the customer by the bank (SMS OTP, secur’pass, etc.). It also depends on the customer’s equipment running the PISP APP used by the customer (PC or mobile/tablet).

- The customer is redirected to the AISP APP. When requesting token recovery, the AISP provides a call back URL: this will be called by the bank.

- You recover the refreshed token for this customer and you can again access the customer’s data for 180 days using the methods in this API.

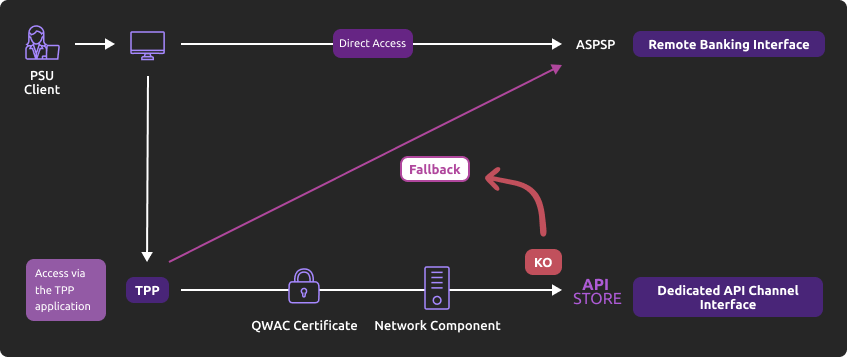

Use fallback

Principle

In accordance with the regulations, Groupe BPCE institutions have set up a dedicated interface for payment service providers: the published PSD2 REST APIs.

If the exposed PSD2 APIs fail, the payment service provider can use the “fallback” solution, which is based on the following principle:

This solution meets the regulatory requirements of PSD2 (article 33 of the RTS). You can use it under the same conditions and prerequisites described in the “Eligibility” section.

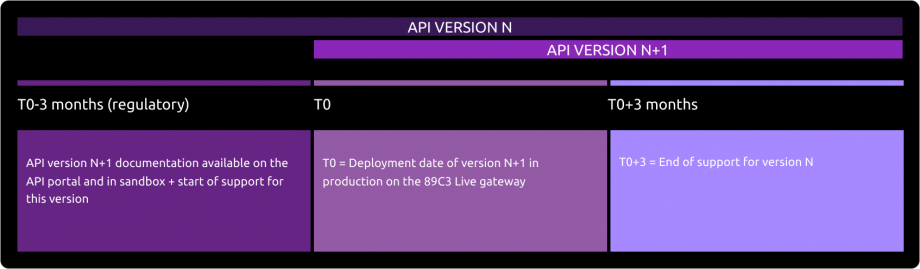

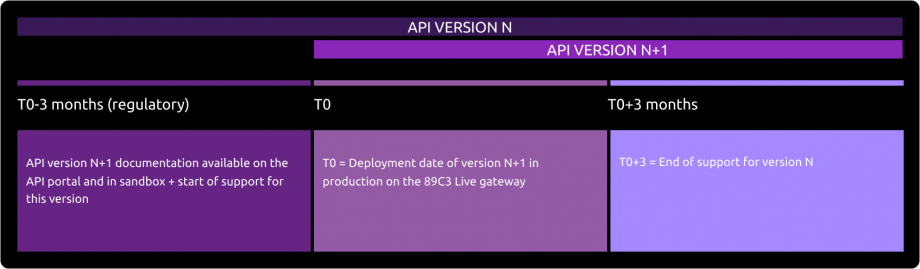

Roadmap

Below are the elements of our forecast trajectory:

| Version | Features | Sandbox Deployment date 89C3 API Dev Portal & Sandbox | Live Deployment date 89C3 Live API Gateway |

| v1.0 | Fallback (*) | Not applicable | End of September 2019 |

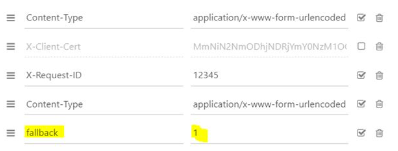

(*) Main functions:

- The TPP uses the same endpoint as the dedicated interface. It therefore depends on the establishment code <cdetab = 13807> which is used to address the correct client repository.

- A request parameter (header “fallback:1” present or absent) added by the TPP makes it possible to distinguish a “Fallback” request from an API request via the dedicated interface, which must be used systematically.

- TPP authentication via mutual TLS authentication using an eIDAS certificate (QWAC)

- Security identical to that for access to the PSU’s online bank (same interface used by the PSU as for direct access, and same means of customer authentication)

- As the use of the dedicated interface (API) ramps up, there is no dynamic switchover: the fallback solution is still active.

- The fallback solution is a back-up solution which must not be used as the main means of access for offering PSD2 services. Its use is monitored and any misuse by one or more TPPs will automatically be reported to the competent national authority.

Example

- In the event that the DPS2 APIs are unexpectedly unavailable or the system fails (see criteria in RTS Art. 33), the TPP can send the request :

POST https://www.<codetab>.oba-bad-me-live.api.89c3.com/stet/psd2/oauth/token

(new URL to be taken into account from now on)

(As a reminder, the existing URL www.<codetab>.live.api.89C3.com will no longer be available as of 28/09/2025)

for example <codetab> =

- 13807 for BPGO

- 10548 for Banque de Savoie

- 40978 for Banque Palatine

with :

- its eIDAS QWAC production certificate

- the header parameter (fallback: “1″)

POST /stet/psd2/oauth/token HTTP/1.1

Content-Type: application/x-www-form-urlencoded

X-Request-ID: 1234

fallback: 1

User-Agent: PostmanRuntime/7.16.3

Accept: */*

Cache-Control: no-cache

Host: www.13807.oba-bad-me-live.api.banquepopulaire.fr

Accept-Encoding: gzip, deflate

Content-Length: 67

Connection: keep-alive

client_id=PSDFR-ACPR-12345&grant_type=client_credentials&scope=aisp

- If the checks are positive, we will return a header url of the type to be used as part of the redirection to the online banking environment, and which contains a JWT token (“&fallback=” fields) which must also be used in this context:

HTTP/1.1 302 Found

Date: Tue, 25 May 2021 21:46:59 GMT

Location: https://www.ibps.bpgo.banquepopulaire.fr/se-connecter/sso?service=cyber&cdetab=13807&fallback=eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1NiIsIng1dCI6ImhF…

</head><body>

<h1>Found</h1>

<p>The document has moved <a >here</a>.</p>

</body></html>

- Once redirected, the TPP must then use the PSU’s identifiers via its proprietary method

For more details on the POST request, see STET V1.6.2.0 / Part I / section 3.4.3

Limits

The constraints of this solution are as follows:

- No reuse of the context of the dedicated interface, or of the access token valid for 180 days (AISP)

- Following the introduction of the new online banking solution, fallback allows you to stay on the old online banking screens

- Only the PSD2 functionalities present in online banking (reference: fixed internet remote banking – not mobile banking) are accessible via fallback. For example, online banking services do not offer e-commerce payments. This PISP functionality is therefore not available in fallback mode.

- The service user customer (PSU) must be connected to the TPP application (no possibility of AISP batch processing to retrieve the customer’s consented data). As PSD2 also imposes a systematic strengthening of strong authentication means (AF/SCA) for remote/online banking access, the authentication means provided to PSU customers will be used (non-exhaustive list):

- Soft token

- SMS OTP

- Physical key (for companies)

Activate App2App

Introduction

This feature automatically activates the customer’s banking app for identification and authentication purposes.

Prerequisites

The customer must have loaded and used the latest version of the banking application on the Android and Apple application shops at least once (version V6.4.0 and above).

Note: PRO & ENT customer segments are not activated

The return link (Universal link) must be defined in advance by the TPP on the same principle as a callback url:

- if this link/url has already been declared on our 89C3 API gateway, there’s nothing else to do

- otherwise the TPP must declare it using our PSD2 Registration API

Our “Universal links” have been declared on iOS and Android platforms. There is no need to access them via, for example, https://www.<codetab>.oba-bad-me-live.api.caisse-epargne.fr/89C3api/accreditation/v2/.well-known/apple-app-site-association, which will return an error.

(new URL to be taken into account from now on)

(As a reminder, the existing URL www.<codetab>.live.api.89C3.com will no longer be available as of 28/09/2025)

Request

The App2App functionality will be activated in production by the TPP app sending a request in the following STET format:

| Brand | App2App endpoint |

|---|---|

| Banque Palatine | http://www.40978.oba-bad-me-live.api.palatine.fr/stet/psd2/oauth/authorize |

| Banque Populaire | http://www.<codetab>.live.api.banquepopulaire.fr/stet/psd2/oauth/authorize (see the list of <codetab> on the Banque Populaire API product sheet) |

| Banque de Savoie | http://www.10548.live.api.banque-de-savoie.fr/stet/psd2/oauth/authorize |

| Caisse d'Epargne | http://www.<codetab>.live.api.caisse-epargne.fr/stet/psd2/oauth/authorize (see the list of <codetab> on the API Caisse d’Epargne product sheet) |

| Banque BCP | http://www.12579.live.api.banquebcp.fr/stet/psd2/oauth/authorize |

| Crédit Coopératif | http://www.42559.live.api.credit-cooperatif.coop/stet/psd2/oauth/authorize |

| BTP Banque | http://www.30258.live.api.btp-banque.fr/stet/psd2/oauth/authorize |

| Natixis Wealth Management | http://www.18919.live.api.natixis.com/stet/psd2/oauth/authorize |

Alternatively, a webview will be displayed via the customer’s smartphone browser in the following cases:

- if the banking app is not loaded on the customer’s smartphone

or

- if the banking app loaded is not compatible with App2App (see prerequisites)

or

- if the other access point call format has been used http://www.<codetab>.oba-bad-me-live.api.89c3.com/stet/psd2/oauth/authorize (which can be useful as a backup in the event of a problem with the App2App

Regulatory Publications

Get your access token

Principle

Your access to the “Account Information Services” APIs is authorised via an access token (access_token) which can be obtained by applying the OAuth2 place standard.

Authorisation token recovery kinematics

- Our customer (PSU) tells you the identity of his account-holding bank.

- You initiate the OAuth2 access token recovery sequence by redirecting the client (PSU), via its Internet browser, to the account-holding bank’s authorisation IT infrastructure (ASPSP) using the command: GET /authorize.

See also STET place specification V1.6.2.0 / Part I / section 3.4.3

- The account-holding bank (ASPSP) will:

- Identify and authenticate its customer using one of the strong authentication methods it offers and presents to the customer;

- Carry out checks related to your profile as an AISP or CBPII (validity of your QWAC and QSEALC certificates and your role, non-revocation of your profile, etc.).

Once these checks have been carried out and if they are conclusive, the bank will redirect the customer (PSU) to your site using your “call-back” URL (redirection) that you will have sent us when you registered as a TPP consumer of our APIs,

- Or during the “GO Live” process via our 89c3 API portal (old procedure);

- Or via the API PSD2 Registration (current procedure).

The AISP must specify a URL for its APP, which will be called up by the bank:

- If the customer has authorised the recovery of their data by AISP

- Or if consent is refused

- Or if the identification and authentication process is interrupted at one of its stages (e.g. timeout on the identification screen or on the strong authentication screen).

If the PSU has authorised you to retrieve its data from its account holder, you will find a short-lived one-time use code in the response to this call.

- Via a POST /token call, you can then ask the account holder directly for your OAuth2 access token (access_token) with the elements received previously, including the single-use code.

NB: /token requests in the Authorization Code flow must be sent WITHOUT the “scope” parameter.

See also STET place specification V1.6.2.0 / Part I / section 3.4.3

- The account-holding bank (ASPSP) will:

- Carry out checks related to your profile as an AISP or CBPII (validity of certificates and your authorisation, non-revocation of your profile, etc.).

- Identify and authenticate yourself as an AISP or CBPII via your certificate, which you will make available to secure the mutual exchange.

- Once these checks have been carried out and if they are conclusive, the bank holding the account will send you an HTTP200 (OK) response containing, among other things, the OAuth2 access token (access_token).

See also STET place specification V1.6.2.0 / Part I / section 3.4.3

- Once you have retrieved the OAuth2 access token (access_token) issued by the bank, you can present it to consume the API resources.

This token is accompanied by a refresh_token valid for 180 days, which you must keep. When your access_token expires, you can request a new one by going to “Use cases” > “Refresh your access token“.

After 180 days, your refresh_token will expire. To retrieve a new one, you will have to repeat the “Retrieve your token” process and go through a new stage of strong customer authentication with their bank (see point 3. above).

For more details, see also OAuth 2.0 Authorization Framework: https://tools.ietf.org/html/rfc6749#section-4.1

Example

An example request is provided in the section “How to test the API" > “Sandbox assembly”.

For more details on the data exchanged, see the “How to test the API” section.

Get the list of accounts

Principle

Get a list of current accounts and deferred debit cards.

Use cases

This service can be used to retrieve a list of the customer’s current accounts, currency account and deferred debit cards (*).

Each account or card is returned with links to view its balances or outstandings and the transactions associated with it.

The resourceId supplied for each account and card will be used as a parameter for requests to retrieve balances and transactions.

The list returned can be paginated if there are a large number of accounts or cards. In this case, links to the first, previous, next and last pages will make it easier to consult the results.

Access to this method is limited to a maximum of 4 batch accesses per calendar day, for a given client, excluding pagination.

In short, this service allows you to:

- list all current accounts and the deferred debit cards linked to them;

- recover current account balances (balances TP, balances in value and balances comptable)

- recover (i.e. : « balances TP » renamed in « minute balance » ) for currency account

- recover outstanding amounts on deferred debit cards (*)

- retrieve the URI for the “GET /end-user-identity” method

- retrieve the URIs for the “GET /accounts/owners”, “GET /accounts/overdraft”, “GET /accounts/balances” and “GET /accounts/transactions” if these methods are consented for associated account

(*) This API only lists active deferred debit cards that have been used (presence of a CB receipt on the card account) at least once in the last two months.

Prerequisites

To make this request, you must meet the eligibility requirements and have retrieved the OAuth2 access token (see “Use case” > “Get your access token”).

Request

GET /accounts

See also the STET place specification V1.6.2.0 / Part II / section 4.2 / page 28

Mandatory or optional bodysuit parameters required to call this service

Optional parameter: PSU-IP-ADDRESS => to be fed if the client is connected.

Result returned

In v1.6.2, all accounts will be systematically retrieved each time they are accessed via the GET /accounts method, whether or not the customer has given consent for each of their accounts. On the other hand, transactions, account owners, balances and authorised overdrafts for each account will only be retrieved on the basis of the consent given for the account (unchanged rule). This makes it possible to retrieve new customer accounts when consent has already been given for another account, without having to reset all the customer’s consents.

In v1.6.2, the schemeName “CPAN” is replaced by “TPAN” to specify that the card number is encoded.

In v1.6.2, it is possible to retrieve the types of PISP transfers possible for the account in the details data valued with “features:” followed by the values “IP” and/or “SCT” and/or “SCT_MULT”.

- Ex: “details”: “features:IP,SCT,SCT_MULT” for a PRO or ENT customer account eligible for SCT (immediate, standing or deferred) or IP (SEPA Instant Payment) single credit transfers and SCT (immediate or deferred) multiple credit transfers.

- Ex: “details”: “features:IP,SCT” for a PART customer account eligible for SCT (immediate, standing or deferred) or IP (SEPA Instant Payment) single credit transfers.

This call allows you to

- retrieve a list of all the customer’s non-consensual accounts without their balances and without the URIs for the GET /accounts/balances, GET /accounts/transactions, GET /accounts/owners, GET /accounts/overdrafts and GET /end-user-identity methods

- retrieve a list of all the customer’s accounts with :

- their balances if the account is part of the “balances” list transmitted via the PUT /consents method

- the URI for the GET /accounts/balances method if the account is part of the “balances” list sent via the PUT /consents method

- the URI for the GET /accounts/transactions method if the account is part of the “transactions” list sent via the PUT /consents method

- the URI for the GET /accounts/overdrafts method if the account is part of the “overdrafts” list sent via the PUT /consents method

- the URI for the GET /accounts/owners method if the account is part of the “owners” list sent via the PUT /consents method

- retrieve the list of all deferred debit cards (*) associated with the accounts granted (including joint accounts) with :

- their outstanding amounts if the deferred debit card is linked to a current account that is part of the “balances” list transmitted using the PUT /consents method

- the URI for the GET /accounts/balances method if the deferred debit card is backed by a current account that is part of the “balances” list sent via the PUT /consents method

- the URI for the GET /accounts/transactions method if the deferred debit card is backed by a current account that is part of the “transactions” list sent via the PUT /consents method

- the URI for the GET /accounts/owners method if the deferred debit card is backed by a current account that is part of the “owners” list sent via the PUT /consents method

- retrieve the URI for the “GET /end-user-identity” method if the “psuIdentity” item has been populated with the value TRUE via the PUT /consents method

- This call does not allow you to recover deferred debit cards for unauthorised current accounts.

The list returned may be paginated if there are a large number of sight accounts or deferred debit cards. In this case, navigation links to the first, previous, next and last pages will make it easier to consult the results.

A link will also be provided to return to the page obtained just after the request has been executed.

Your access to this method is limited to a maximum of 4 batch accesses per calendar day, for a given customer (including any pagination). On the other hand, when the connected customer queries his current accounts directly, the number of accesses is not limited.

The “psuStatus” property is set to “Account Co-Holder” if the customer is not the only account holder.

(*) The API AISP of the Banques Populaires, Banque de Savoie and Banque Palatine only retrieves deferred debit cards that are active and have been used (presence of a CB receipt on the card account) at least once in the last two months: active deferred debit cards that have no card outstandings in the current month or in the previous month are not retrieved by the “GET /accounts” request.

Example without consent given via PUT /consents

Request

GET /stet/psd2/v1.6.2/accounts/

Results

Status code : 200

Body

{

“_links”: { “last”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts?page=last” }, “self”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts” }, “first”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts” }, “endUserIdentity”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/end-user-identity” } }, “accounts”: [ { “cashAccountType”: “CACC”, “accountId”: { “iban”: “FR7613807008043001965409135” “currency”: “EUR”, }, “resourceId”: “038-CPT30019654091”, “product”: “CURRENT ACCOUNT”, “_links”: {}, “usage”: “ORGA”, “psuStatus”: “Account Holder”, “name”: “Tech-N Co”, “bicFi”: “CCBPFRPPNAN”, “details”: “CURRENT ACCOUNT” } ]}

Example with consent given via PUT /consents and return of deferred debit card

Request

GET /stet/psd2/v1.6.2/accounts/

Results

Status code : 200

Body

{

“_links: {

“last”: { “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts?page=last” }, “self”: { “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts” }, “first”: { “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts” }, “endUserIdentity”: { “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/end-user-identity” } }, “accounts”: [ { “cashAccountType”: “CACC”, “accountId”: { “iban”: “FR7613807008063031966574122”, “currency”: “EUR” }, “resourceId”: “038-CPT30319665741”, “product”: “CHEQUE ACCOUNT”, “balances”: [ { “balanceType”: “VALU”, “name”: “Value Balance”, “balanceAmount”: { “amount”: “0”, “currency”: “EUR” }, “referenceDate”: “2020-06-05” }, { “balanceType”: “CLBD”, “name”: “Account Balance”, “balanceAmount”: { “amount”: “0”, “currency”: “EUR” }, “referenceDate”: “2020-06-04” }, { “balanceType”: “OTHR”, “name”: “Solde TP”, “balanceAmount”: { “amount”: “0”, “currency”: “EUR” } ], “_links”: { “balances”: { “templated”: false, “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30319665741/balances” }, “transactions”: { “templated”: false, “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30319665741/transactions” } }, “usage”: “PRIV”, “psuStatus”: “Account Holder”, “name”: “BARDE ADAM”, “bicFi”: “CCBPFRPPNAN”, “details”: “COMPTE CHEQUE” }, { “cashAccountType”: “CACC”, “accountId”: { “iban”: “FR7613807008063031966574219”, “currency”: “EUR” }, “resourceId”: “038-CPT30319665742”, “product”: “CURRENT ACCOUNT”, “balances”: [ { “balanceType”: “VALU”, “name”: “Balance in Value”, “balanceAmount”: { “amount”: “-2894.05”, “currency”: “EUR” }, “referenceDate”: “2020-06-05” }, { “balanceType”: “CLBD”, “name”: “Account Balance”, “balanceAmount”: { “amount”: “-2894.05”, “currency”: “EUR” }, “referenceDate”: “2020-06-04” }, { “balanceType”: “OTHR”, “name”: “Solde TP”, “balanceAmount”: { “amount”: “-2894.05”, “currency”: “EUR” } } ],”_links”: { “balances”: { “templated”: false, “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30319665742/balances” }, “transactions”: { “templated”: false, “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30319665742/transactions” } }, “usage”: “ORGA”, “psuStatus”: “Account Holder”, “name”: “SARL UNI PICCOLO”, “bicFi”: “CCBPFRPPNAN”, “details”: “CURRENT ACCOUNT” }, { “cashAccountType”: “CARD”, “accountId”: { “other”: { “identification”: “C01WcBfYTK70wJJ5LpsMI3EGQ==”, “schemeName”: “TPAN”, “issuer”: “13807” }, “currency”: “EUR” }, “resourceId”: “038-GFCC01WcBfYTK70wJJ5LpsMI3EGQ”, “product”: “Visa Classic”, “balances”: [ { “balanceType”: “ITAV”, “name”: “Outstanding”, “balanceAmount”: { “amount”: “0”, “currency”: “EUR” }, “referenceDate”: “2020-06-30” }, { “balanceType”: “PRCD”, “name”: “Last amount drawn”, “balanceAmount”: { “amount”: “78.65”, “currency”: “EUR” }, “referenceDate”: “2020-05-31” } ], “_links”: { “balances”: { “templated”: false, “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-GFCC01WcBfYTK70wJJ5LpsMI3EGQ/balances” }, “transactions”: { “templated”: false, “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-GFCC01WcBfYTK70wJJ5LpsMI3EGQ/transactions” } }, “usage”: “PRIV”, “psuStatus”: “Account Holder”, “name”: “M ADAM BARDE XX9351”, “linkedAccount”: “038-CPT30319665741”, “bicFi”: “CCBPFRPPNAN”, “details”: “CB VISA FACELIA DEBIT DIFFERE” }, { “cashAccountType”: “CARD”, “accountId”: { “other”: { “identification”: “C01mS9kXqK80z5X19/E7WmZjw==”, “schemeName”: “TPAN”, “issuer”: “13807” }, “currency”: “EUR” }, “resourceId”: “038-GFCC01mS9kXqK80z5X19_E7WmZjw”, “product”: “Visa Classic”, “balances”: [ { “balanceType”: “ITAV”, “name”: “Outstanding”, “balanceAmount”: { “amount”: “0”, “currency”: “EUR” }, “referenceDate”: “2020-06-30” }, { “balanceType”: “PRCD”, “name”: “Last amount drawn”, “balanceAmount”: { “amount”: “156.27”, “currency”: “EUR” }, “referenceDate”: “2020-05-31” } ], “_links”: { “balances”: { “templated”: false, “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-GFCC01mS9kXqK80z5X19_E7WmZjw/balances” }, “transactions”: { “templated”: false, “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-GFCC01mS9kXqK80z5X19_E7WmZjw/transactions” } }, “usage”: “PRIV”, “psuStatus”: “Account Holder”, “name”: “M ADAM BARDE XX4620”, “linkedAccount”: “038-CPT30319665741”, “bicFi”: “CCBPFRPPNAN”, “details”: “VISA INTERNATIONALE DB DIFFERE” } ]}

(Adam persona case – D0999994I0)

Example of pagination

Request

GET /stet/psd2/v1.6.2/accounts?page=1

Results

Status code : 200

Body

“accounts”: [ { “cashAccountType”: “CACC”, “accountId”: { “iban”: “FR7613807008043099888880699″, “currency”: “EUR” }, “resourceId”: “038-CPT30998888806″, “product”: “CHEQUE ACCOUNT”, “balances”: [ { “balanceType”: “VALU”, “name”: “Value Balance”, “balanceAmount”: { “amount”: “6.78”, “currency”: “EUR” }, “referenceDate”: “2020-06-05”}, { “balanceType”: “CLBD”, “name”: “Account Balance”, “balanceAmount”: { “amount”: “6.78”, “currency”: “EUR” }, “referenceDate”: “2020-06-04”}, { “balanceType”: “OTHR”, “name”: “Solde TP”, “balanceAmount”: { “amount”: “6.78”, “currency”: “EUR” } } ],”_links”: { “balances”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888806/balances” }, “transactions”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888806/transactions” } }, “usage”: “PRIV”, “psuStatus”: “Nominee”, “name”: “Compte mensualités”, “bicFi”: “CCBPFRPPNAN”, “details”: “COMPTE CHEQUE” }, { “cashAccountType”: “CACC”, “accountId”: { “iban”: “FR7613807008043099888880799”, “currency”: “EUR” }, “resourceId”: “038-CPT30998888807”, “product”: “CHEQUE ACCOUNT”, “balances”: [ { “balanceType”: “VALU”, “name”: “Balance in Value”, “balanceAmount”: { “amount”: “7.6”, “currency”: “EUR” }, “referenceDate”: “2020-06-05” }, { “balanceType”: “CLBD”, “name”: “Balde Comptable”, “balanceAmount”: { “amount”: “7.6”, “currency”: “EUR” }, “referenceDate”: “2020-06-04” }, { “balanceType”: “OTHR”, “name”: “Solde TP”, “balanceAmount”: { “amount”: “7.6”, “currency”: “EUR” } } ],”_links”: {“balances”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888807/balances” }, “transactions”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888807/transactions” } }, “usage”: “PRIV”, “psuStatus”: “Successor On Death”, “name”: “Compte perso”, “bicFi”: “CCBPFRPPNAN”, “details”: “COMPTE CHEQUE” }, { “cashAccountType”: “CACC”, “accountId”: { “iban”: “FR7613807008043099888880899”, “currency”: “EUR” }, “resourceId”: “038-CPT30998888808”, “product”: “CHEQUE ACCOUNT”, “balances”: [ { “balanceType”: “VALU”, “name”: “Balance in Value”, “balanceAmount”: { “amount”: “8.8”, “currency”: “EUR” }, “referenceDate”: “2020-06-05” }, { “balanceType”: “CLBD”, “name”: “Account Balance”, “balanceAmount”: {“amount”: “8.8”, “currency”: “EUR”}, “referenceDate”: “2020-06-04”},{“balanceType”: “OTHR”, “name”: “Solde TP”, “balanceAmount”: { “amount”: “8.8”, “currency”: “EUR” } } ],”_links”: { “balances”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888808/balances” }, “transactions”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888808/transactions” }}, “usage”: “PRIV”, “psuStatus”: “Trustee”, “name”: “Retrait et Cheques”, “bicFi”: “CCBPFRPPNAN”, “details”: “COMPTE CHEQUE 8” }, { “cashAccountType”: “CACC”, “accountId”: { “iban”: “FR7613807008043099888880999”, “currency”: “EUR” }, “resourceId”: “038-CPT30998888809”, “product”: “CHEQUE ACCOUNT”, “balances”: [ { “balanceType”: “VALU”, “name”: “Balance in Value”, “balanceAmount”: { “amount”: “9.9”, “currency”: “EUR” }, “referenceDate”: “2020-06-05” }, { “balanceType”: “CLBD”, “name”: “Account Balance”, “balanceAmount”: { “amount”: “9.9”, “currency”: “EUR” }, “referenceDate”: “2020-06-04”},{ “balanceType”: “OTHR”, “name”: “Solde TP”, “balanceAmount”: { “amount”: “9.9”, “currency”: “EUR” } } ],”_links”: { “balances”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888809/balances” }, “transactions”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888809/transactions” } }, “usage”: “PRIV”, “psuStatus”: “Trustee”, “name”: “Retrait et Cheques”, “bicFi”: “CCBPFRPPNAN”, “details”: “COMPTE CHEQUE 9” }, { “cashAccountType”: “CACC”, “accountId”: {“iban”: “FR7613807008043099888881099″, “currency”: “EUR”}, “resourceId”: “038-CPT30998888810″, “product”: “CHEQUE ACCOUNT”, “balances”: [ { “balanceType”: “VALU”, “name”: “Balance in Value”, “balanceAmount”: { “amount”: “10.10”, “currency”: “EUR” }, “referenceDate”: “2020-06-05” }, { “balanceType”: “CLBD”, “name”: “Account Balance”, “balanceAmount”: { “amount”: “10.10”, “currency”: “EUR” }, “referenceDate”: “2020-06-04” }, { “balanceType”: “OTHR”, “name”: “Solde TP”, “balanceAmount”: { “amount”: “10.10”, “currency”: “EUR” } } ], “_links”: { “balances”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888810/balances” }, “transactions”: { “templated”: false, “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30998888810/transactions” } }, “usage”: “PRIV”, “psuStatus”: “Trustee”, “name”: “Withdrawal and Cheques”, “bicFi”: “CCBPFRPPNAN”, “details”: “ACCOUNT CHEQUE 10” } ], “_links”: { “next”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts?page=3” }, “last”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts?page=last” }, “prev”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts” }, “self”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts?page=2” }, “first”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts” }, “endUserIdentity”: { “href“: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/end-user-identity” } }

Example with a currency account

Request

GET /stet/psd2/v1.6.2/accounts/

Result

Status code : 200

Body

{« _links »: {« last »: {« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts?page=last »},« self »: {« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts »},« first »: {« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts »},« endUserIdentity »: {« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/end-user-identity »}},« accounts »: [{« cashAccountType »: « CACC »,« accountId »: {« iban »: « FR7613807008063031966574122 »,« currency »: « EUR »},« resourceId »: « 038-CPT30319665741 »,« product »: « COMPTE CHEQUE »,« balances »: [{« balanceType »: « VALU »,« name »: « Solde en Valeur »,« balanceAmount »: {« amount »: « 0 »,« currency »: « EUR »},« referenceDate »: « 2020-06-05 »},{« balanceType »: « CLBD »,« name »: « Solde Comptable »,« balanceAmount »: {« amount »: « 0 »,« currency »: « EUR »},« referenceDate »: « 2020-06-04 »},{« balanceType »: « OTHR »,« name »: « Solde TP »,« balanceAmount »: {« amount »: « 0 »,« currency »: « EUR »}}],« _links »: {« balances »: {« templated »: false,« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30319665741/balances »},« transactions »: {« templated »: false,« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30319665741/transactions »}},« usage »: « PRIV »,« psuStatus »: « Account Holder »,« name »: « BARDE ADAM »,« bicFi »: « CCBPFRPPNAN »,« details »: « COMPTE CHEQUE »},{« cashAccountType »: « CACC »,« accountId »: {« iban »: « FR7613807008063031966574219 »,« currency »: « EUR »},« resourceId »: « 038-CPT30319665742 »,« product »: « COMPTE COURANT »,« balances »: [{« balanceType »: « VALU »,« name »: « Solde en Valeur »,« balanceAmount »: {« amount »: « -2894.05 »,« currency »: « EUR »},« referenceDate »: « 2020-06-05 »},{« balanceType »: « CLBD »,« name »: « Solde Comptable »,« balanceAmount »: {« amount »: « -2894.05 »,« currency »: « EUR »},« referenceDate »: « 2020-06-04 »},{« balanceType »: « OTHR »,« name »: « Solde TP »,« balanceAmount »: {« amount »: « -2894.05 »,« currency »: « EUR »}}],« _links »: {« balances »: {« templated »: false,« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30319665742/balances »},« transactions »: {« templated »: false,« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30319665742/transactions »}},« usage »: « ORGA »,« psuStatus »: « Account Holder »,« name »: « SARL UNI PICCOLO »,« bicFi »: « CCBPFRPPNAN »,« details »: « COMPTE COURANT »},{« cashAccountType »: « CARD »,« accountId »: {« other »: {« identification »: « C01WcBfYTK70wJJ5LpsMI3EGQ== »,« schemeName »: « TPAN »,« issuer »: « 13807 »},« currency »: « EUR »},« resourceId »: « 038-GFCC01WcBfYTK70wJJ5LpsMI3EGQ »,« product »: « Visa Classic »,« balances »: [{« balanceType »: « ITAV »,« name »: « Encours »,« balanceAmount »: {« amount »: « 0 »,« currency »: « EUR »},« referenceDate »: « 2020-06-30 »},{« balanceType »: « PRCD »,« name »: « Dernier encours prélevé »,« balanceAmount »: {« amount »: « 78.65 »,« currency »: « EUR »},« referenceDate »: « 2020-05-31 »},],« _links »: {« balances »: {« templated »: false,« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-GFCC01WcBfYTK70wJJ5LpsMI3EGQ/balances »},« transactions »: {« templated »: false,« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-GFCC01WcBfYTK70wJJ5LpsMI3EGQ/transactions »}},« usage »: « PRIV »,« psuStatus »: « Account Holder »,« name »: « M ADAM BARDE XX9351 »,« linkedAccount »: « 038-CPT30319665741 »,« bicFi »: « CCBPFRPPNAN »,« details »: « CB VISA FACELIA DEBIT DIFFERE »},{« cashAccountType »: « CARD »,« accountId »: {« other »: {« identification »: « C01mS9kXqK80z5X19/E7WmZjw== »,« schemeName »: « TPAN »,« issuer »: « 13807 »},« currency »: « EUR »},« resourceId »: « 038-GFCC01mS9kXqK80z5X19_E7WmZjw »,« product »: « Visa Classic »,« balances »: [{« balanceType »: « ITAV »,« name »: « Encours »,« balanceAmount »: {« amount »: « 0 »,« currency »: « EUR »},« referenceDate »: « 2020-06-30 »},{« balanceType »: « PRCD »,« name »: « Dernier encours prélevé »,« balanceAmount »: {« amount »: « 156.27 »,« currency »: « EUR »},« referenceDate »: « 2020-05-31 »}],« _links »: {« balances »: {« templated »: false,« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-GFCC01mS9kXqK80z5X19_E7WmZjw/balances »},« transactions »: {« templated »: false,« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-GFCC01mS9kXqK80z5X19_E7WmZjw/transactions »}},« usage »: « PRIV »,« psuStatus »: « Account Holder »,« name »: « M ADAM BARDE XX4620 »,« linkedAccount »: « 038-CPT30319665741 »,« bicFi »: « CCBPFRPPNAN »,« details »: « VISA INTERNATIONALE DB DIFFERE »},{« cashAccountType »: « CACC »,« accountId »: {« iban »: « FR7613807008063031966574316 »,« currency »: « USD »},« resourceId »: « 038-CDV30319665743USD »,« product »: « COMPTE EN DEVISE 049USD »,« balances »: [{« name »: « Encours minute »,« balanceAmount »: {« currency »: « USD »,« amount »: « 1500.00 »},« balanceType »: « OTHR »}],« _links »: {« balances »: {« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CDV30319665743USD/balances »},« transactions »: {« href »: « https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CDV30319665743USD/transactions »}},« usage »: « PRIV »,« psuStatus »: « Account Holder »,« name »: « BARDE ADAM »,« bicFi »: « CCBPFRPPNAN »,« details »: « »}]}

(Adam persona case – D0999994I0)

A more complete example of a request is provided in the section “How to test the API” > “Sandbox assembly”.

Error codes

Here is the list of error code descriptions for this service.

| Error | Description of error |

|---|---|

| AC01 (CFONB) | IncorrectAccountNumber: the account number is incorrect or unknown |

| AC04 (CFONB) | ClosedAccountNumber: the account is closed |

| AC06 (CFONB) | BlockedAccount: the account is blocked / subject to an objection |

| BE05 (CFONB) | UnrecognisedInitiatingParty: the AISP is unknown |

| BADS | BadScope: the call to the service was made with a CBPII token (AISP expected) |

| INTE | InternalError: there is an internal processing error |

| INTS | InternalServerError: there is an internal error communicating with the IS |

| IPGN | InvalidPageNumber: the page number is invalid |

| NAAC | No available accounts: no eligible or approved accounts |

| NGAC | NotGrantedAccount: the account is not granted |

| ISPM | NotImplemented: the wrong verb is called (GET expected) |

| TMRQ | TooManyRequest: the number of possible requests has been exceeded |

| IPSU | InvalidPSU: Subscriber number not listed or remote banking subscription cancelled |

Acceptance testing

The aim of these test cases is to enable you to carry out a minimum number of tests to get to grips with this API and access it from your application.

| Test description | Dataset |

|---|---|

Retrieve all a customer’s accounts (at least 2 must be present at ASPSP level) => Check the links in the query result (self link, balances and transactions) | Persona : Alix – D0999992I0 Prerequisites : scope OAuth2 = aisp Result: HTTP 200 response => OK return of three payment accounts and three deferred debit cards |

Recover several accounts linked to the client and check that the ASPSP manages the paging mechanism correctly => Check for optional links: first, previous, next, last. | Persona : Marc – D0999990I0 Prerequisites : scope OAuth2 = aisp Result: HTTP 200 response => OK all three accounts on the same page |

Recover several accounts and cards linked to the customer and check that the ASPSP correctly manages the paging mechanism => Check for optional links: first, previous, next, last. | Persona : Adam – D0999994I0 Prerequisites : scope OAuth2 = aisp Result: HTTP 200 response => OK return of two accounts and two deferred debit cards |

| HTTP request with an unauthorised access token for the resource (incorrect scope) | Persona : Marc – D0999990I0 Prerequisites : scope OAuth2 <> aisp Result: HTTP403 response => access to the resource refused error message: BADS |

| Passing an HTTP POST request | Persona : Marc – D0999990I0 Prerequisites : scope OAuth2 = aisp Result: HTTP405 response => unauthorised method |

Send the list of accounts

Principle

Manage and transmit the list of current accounts granted by the PSU for consultation of balances and/or transactions and/or overdraft authorisation.

Use cases

This service enables the customer’s consent to be recorded.

This consent contains details of the access granted by the customer.

Four types of access can be defined:

- “balances” ⇒ access to the balances of one or more customer accounts

- “transactions” ⇒ access to transactions on one or more customer accounts

- “overdrafts” ⇒ access to authorised overdrafts on one or more customer accounts

- “owners” ⇒ access to holders of one or more customer accounts

- “psuIdentity” ⇒ access to customer identity data (first and last name)

- “trustedBeneficiaries” ⇒ access to the customer’s list of trusted beneficiaries: this functionality is not available (see “Limitations”).

Consent is recorded for a given customer.

Each new call to the consent registration service for a given customer will cancel and replace the previous consent where applicable.

Furthermore, at the customer’s request, consent can be subsequently modified by type of transaction: for example, consent for access to transaction history can be revoked while consent for balances remains active.

Consent on an account for a specific currency gives consent of this same account on any currency supported by this account.

Consent is checked each time a request is made.

In short, this service enables you to transmit the IBANs of current accounts for which the customer has authorised you to consult details of balances and/or transactions and/or the authorised overdraft and/or the account’s owner(s), as well as the customer’s identity.

Prerequisites

You can retrieve the list of the customer’s current accounts after calling the GET /accounts request once: you will find the IBAN associated with each current account, i.e. as “accountId“: {“iban”:”” }.

However, if you already know the IBAN(s) of the customer’s current accounts, you can send them to us directly using the PUT /consents method. In this case, you must meet the eligibility requirements and have recovered the OAuth2 access token (see “Use cases” > “Get your access token”).

Request

PUT /consents

Mandatory or optional bodysuit parameters required to call this service

balances: compulsory table but may be empty: list of accounts accessible for the “balances” function ⇒ iban – compulsory: International Bank Account Number (IBAN)

transactions: mandatory table, which may be empty: list of accounts accessible for the “transactions” functionality ⇒ iban – mandatory: International Bank Account Number (IBAN)

overdrafts: compulsory table but can be empty: list of accounts accessible for the “overdrafts” functionality ⇒ iban – compulsory: International Bank Account Number (IBAN)

owners: compulsory table but can be empty: list of accounts accessible for the “owners” function ⇒ iban – compulsory: International Bank Account Number (IBAN)

trustedBeneficiaries: mandatory: value (true or false) indicating whether access to the list of trusted beneficiaries is authorised for the AISP by the client.

psuIdentity: mandatory: value (true or false) indicating whether access to the client’s identity (first name, surname) is authorised for the AISP by the client.

Optional parameter: PSU-IP-ADDRESS ⇒ to be fed if the client is connected

Result returned

This call is used to record the sight accounts that the customer has granted you.

The customer can grant you 6 types of access:

- “psuIdentity” ⇒ access to the customer’s identity (surname and first name for a “private individual” customer)

- The client’s identity can only be accessed via the GET /end-user-identity method if the client has consented to it.

- “transactions” ⇒ access to the transactions of one or more current accounts and the related deferred debit card invoices

- Current account transactions and related deferred debit card invoices are accessible via the GET /accounts method and via the GET /accounts/transactions method for authorised accounts only.

- “balances” ⇒ access to the balances of one or more current accounts and the associated deferred debit cards :

- Sight account balances and related deferred debit card outstandings can be accessed via the GET /accounts method and via the GET /accounts/balances method for authorised accounts only.

- “overdrafts ⇒ access to authorised overdrafts on one or more current accounts

- Authorised overdrafts on current accounts can be accessed via the GET /accounts method and via the GET /accounts/overdrafts method for authorised accounts only.

- “owners ⇒ access to holders of one or more current accounts

- Account owner(s) and related deferred debit card outstandings can be accessed via the GET /accounts method and via the GET /accounts/owners method for authorised accounts only.

- If you do not transmit any accounts using the PUT /consents method, even though accounts were granted using the last call to this method, this means that the customer has revoked all the accounts granted.

If no current account has been granted or if the customer has revoked all the accounts granted, the GET /accounts method allows you to retrieve the list of all current accounts, but access to the balances, transactions, account owner(s) and authorised overdraft of current accounts and access to deferred debit cards and their outstandings, owner(s) and invoices is not/no longer possible.

Example

Request

PUT /stet/psd2/v1.6.2/consents/

A more complete example of a request is provided in the section “How to test the API” > “Sandbox assembly”.

See also STET place specification V1.6.2.0 / Part III / section 6.2 / page 6

Results

Status code : 201

The consent service returns a code “201 – Created” when registering consent

The consent service returns a “403 – Forbidden” code if registration fails

Body

{“balances”: [{“iban”: “FR7613807008043001965405158”},{“iban”: “FR7613807008043001965405255”},{“iban”: “FR7613807008043001965405352”}],

“transactions”: [{“iban”: “FR7613807008043001965405158”},{“iban”: “FR7613807008043001965405255”},{“iban”: “FR7613807008043001965405352”}],

“owners”: [ { “iban”: “FR7613807008043001965405158” } ], “overdrafts”: [ { “iban”: “FR7613807008043001965405158″ } ], “trustedBeneficiaries”: true, “psuIdentity”: true}

Note: (case of persona Marc – D0999990I0)

- the “currency” field has been added to the “AccountIdentification” field

Example with currency account

Request

PUT /stet/psd2/v1.6.2/consents/

Results

Status code : 201

Body

{“balances”: [{“iban”: “FR761380700806303196657431”, “currency”: “USD”}],

“transactions”: [{“iban”: “FR761380700806303196657431”, “currency”: “USD”}],

“owners”: [{“iban”: “FR761380700806303196657431”, “currency”: “USD”}],

“overdrafts”: [{“iban”: “FR761380700806303196657431”, “currency”: “USD”}

],

“trustedBeneficiaries”: true,

“psuIdentity”: true

}

(case of persona Adam – D0999994I0)

Error codes

Here is the list of error code descriptions for this service.

| Error | Description of error |

|---|---|

| AC01 (CFONB) | IncorrectAccountNumber: IBAN is incorrect or unknown |

| AC04 (CFONB) | ClosedAccountNumber: the account is closed |

| AC06 (CFONB) | BlockedAccount: the account is blocked / subject to an objection |

| BE05 (CFONB) | UnrecognisedInitiatingParty: the AISP is unknown |

| BADS | BadScope: the call to the service was made with a CBPII token (AISP expected) |

| ENDE | EntriesDatesError: one or more dates are wrong |

| IPGN | InvalidPageNumber: the page number is invalid |

| INTE | InternalError: there is an internal processing error |

| INTS | InternalServerError: there is an internal error communicating with the IS |

| NGAC | NotGrantedAccount: the account is not granted |

| ISPM | NotImplemented: the wrong verb is called (GET expected) |

| TQMR | TooManyRequest: the number of possible requests has been exceeded |

| RENF | ReferenceNotFound: the transaction reference does not exist |

| IPSU | InvalidPSU: Subscriber number not listed or remote banking subscription cancelled |

| FF01 | Incorrect body format (empty body, missing mandatory data) |

| NAAC | NotAvailableAccounts: absence of eligible accounts |

| CDNA | CardNotAvailable: the deferred debit card is not or no longer accessible |

Acceptance testing

The aim of these test cases is to enable you to carry out a minimum number of tests to get to grips with this API and access it from your application.

| Test description | Data set and expected result |

|---|---|

| Recording of customer consent data | Persona : Marc – D0999990I0 Prerequisites : scope OAuth2 = aisp IBANs : FR7613807008043001965405158 FR7613807008043001965405255 FR7613807008043001965405352 Result: HTTP response 201 => OK, consent recorded |

| Recording of customer consent data | Persona : Adam – D0999994I0 Prerequisites : scope OAuth2 = aisp IBANs : FR7613807008063031966574122 FR7613807008063031966574219 Result: HTTP response 201 => OK, consent recorded |

| HTTP request passed with an unauthorised access token for the resource (incorrect scope) | Persona : Marc – D0999990I0 Prerequisites : scope OAuth2 <> aisp IBANs : FR7613807008043001965405158 FR7613807008043001965405255 FR7613807008043001965405352 Result: HTTP 403 response => access to the resource refused error message: BADS |

| Passing an HTTP POST request | Persona : Marc – D0999990I0 Prerequisites : scope OAuth2 = aisp IBANs : FR7613807008043001965405158 FR7613807008043001965405255 FR7613807008043001965405352 Result: HTTP 405 response => unauthorised method |

Get accounting balances

Principle

Obtain current account balances or deferred debit card outstandings!

Use cases

This service can be used to retrieve a list of balances on a current account or the amounts outstanding on a customer’s deferred debit card.

This service follows on from the return of the list of a customer’s accounts and cards: a resourceId corresponding to an account or card must be supplied to obtain the list of balances or outstandings.

3 types of balance will be returned for an account in EURO passed as a parameter:

- Value balance (“VALU” in the STET standard) ⇒ balance displayed in relation to a value date

- Accounting balance (“CLBD” in the STET standard) ⇒ accounting balance at end of period (end of week, end of month, end of quarter, end of half-year, end of year)

- TP balance (“OTHR” in the STET standard) ⇒ instantaneous balance (changes in real time with each entry on the account)

1 unique type of balance will be returned for an account in currency (i.e. : except EURO, ex. USD / JPY / …) passed as a parameter:

- Minute balance (“OTHR” in the STET standard) ⇒ instantaneous balance (changes in real time with each entry on the account)

3 types of outstandings will be returned if a card is passed as a parameter:

- Outstanding amounts (“ITAV” in the STET standard) ⇒ amount of invoices carried over to the following month

- Finished outstanding amount (“ITAV” in the STET standard) ⇒ corresponds to the amount of the current month’s invoices not yet booked

- Outstanding amounts drawn down (“PRCD” in the STET standard) ⇒ corresponds to the amount of the previous month’s invoices

In v1.6.2, the amount of card outstandings has been made negative (it was positive in v1.4.2 and v1.4.0).

The list returned can be paginated if there is a lot of data to display, in which case links to the first, previous, next and last pages will make it easier to consult the results.

Access to this method is limited to a maximum of 4 batch accesses per calendar day, for a given customer and account/debit card.

In short, this service can be used to list the balances on a customer’s current account or to list the amounts outstanding on a deferred debit card attached to that current account.

Prerequisites

To make this request, you must meet the eligibility requirements and have retrieved the OAuth2 access token (see “Use cases” > “Get your acccess token”).

To recover the balance on a current account:

- The account IBAN must have been sent to us in the “balances” list in the PUT /consents method and must not have been revoked since then (<= no cancel and replace via PUT /consents without this IBAN in the “balances” list).

- The “accountResourceId” used to query this method for this current account is retrieved via the result of the GET /accounts request in the “resourceId” field for the current account corresponding to this IBAN, i.e. such that “accountId”: {“iban”:””}

- The URI for accessing this method is given in the “_links” field: {“balances”:”{“href”: …}} as the result of the GET /accounts request for the “resourceId” of the current account.

To recover amounts outstanding on a deferred debit card attached to a current account:

- The IBAN of the current account to which the deferred debit card is linked must have been sent to us in the “balances” list in the PUT /consents method and must not have been revoked since (<= no cancel and replace via PUT /consents without this IBAN in the “transactions” list).

- The “accountResourceId” used to query this method for the deferred debit card is retrieved via the result of the GET /accounts request in the “resourceId” field for the deferred debit card, i.e. : such as “accountId”: {“other”:”{“schemeName”: TPAN}} with “linkedAccount” which corresponds to the “resourceId” of the current account with the “resourceId” of the current account retrieved via the GET /accounts request and such as “accountId”: {“iban”:””}

- The URI for accessing this method is given via the “_links” heading: {“balances”:”{“href”: …}} in the result of the GET /accounts request for the “resourceId” of the deferred debit card.

Request

GET /accounts/{accountResourceId}/balances request

See also STET place specification V1.6.2.0 / Part II / Section 4.4.4 / page 33

Mandatory or optional bodysuit parameters required to call this service

Parameter accountResourceId: current account for which you want to view balances or deferred debit card for which you want to view outstandings. This data corresponds to the “resourceId” item obtained in the results page of the GET /accounts request.

Optional parameter: PSU-IP-ADDRESS ⇒ to be fed if the PSU is connected.

Result returned

This call retrieves:

- the list of balances for the current account passed in parameter

- or the list of outstandings for the deferred debit card passed as a parameter.

3 types of balance will be returned if a current account (in EURO) is passed as a parameter:

| Value balance (“VALU” in the STET standard) | ⇒ balance displayed in relation to a value date. The value balance is not available while the accounting batch is running (in principle between 9pm and 9.50pm). |

| Accounting balance (“CLBD” in the STET standard) | ⇒ accounting balance at the end of the period (end of week, end of month, end of quarter, end of half-year, end of year). For a newly created account, the accounting balance is not available until the first accounting batch is run. |

| TP balance (“OTHR” in the STET standard) | ⇒ instant balance (changes in real time with each entry to the account) |

1 unique type of balance will be returned if a current account in currency (i.e. : except EURO, ex. USD / JPY / …) is passed as a parameter:

| TP balance (“OTHR” in the STET standard) | ⇒ instant balance (changes in real time with each entry to the account) |

3 types of outstandings can be returned for a card passed as a parameter:

| Outstanding amounts (“ITAV” in the STET standard) | ⇒ amount of invoices carried over to the following month |

| Finished outstanding amount not drawn down (“ITAV” in the STET standard) | ⇒ corresponds to the amount of the current month’s invoices not yet booked |

| Finished amount drawn down (“PRCD” in the STET standard) | ⇒ corresponds to the amount of the previous month’s invoices |

A self link will also be present to return to the page obtained after executing the request.

Your accesses to this method are limited to a maximum of 4 batch accesses per calendar day, for a given customer and for a given current account or deferred debit card (modulo any pagination). On the other hand, when it is the connected customer who queries his current accounts directly, the number of accesses is not limited.

Example

Request

“GET /stet/psd2/v1.6.2/accounts/038-CPT30019654051/balances”

An example request is provided in the “How to test the API“ > “Sandbox assembly“.

The test datasets are described in the section “How to test the API“ > “Test data“.

See also the STET specification V1.6.2.0 / Part III / Section 6.5 / page 9

Results

Status code : 200

Body

{ “balances”: [ { “balanceType”: “VALU”, “name”: “Value Balance”, “balanceAmount”: { “amount”: “2165.5”, “currency”: “EUR” }, “referenceDate”: “2020-06-08” }, { “balanceType”: “CLBD”, “name”: “Accounting Balance”, “balanceAmount”: { “amount”: “2165.5”, “currency”: “EUR” }, “referenceDate”: “2020-06-07” }, { “balanceType”: “OTHR”, “name”: “Solde TP”, “balanceAmount”: { “amount”: “2165.5”, “currency”: “EUR” } } ], “_links”: { “self”: { “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30019654051/balances” }, “transactions”: { “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts/038-CPT30019654051/transactions” }, “parent-list”: { “href”: “https://www.rs-sandbox.api.89c3.com/stet/psd2/v1.6.2/accounts” }}

(case of persona Marc – D0999990I0)

Example with a currency account

Request

“GET /stet/psd2/v1.6.2/accounts/038-CDV30319665743USD/balances”

Results

Status code : 200

Body

{

“balances”: [{“name”: “Encours minute”,”balanceAmount”: {“currency”: “USD”,”amount”: “1500.00”},”balanceType”: “OTHR”}],

“_links”: {

“self”: {“href”: “http://localhost:8082/stet/psd2/v1.6.2/accounts/038-CDV30319665743USD/balances”},

“transactions”: {“href”: “http://localhost:8082/stet/psd2/v1.6.2/accounts/038-CDV30319665743USD/transactions”},

“overdrafts”: {“href”: “http://localhost:8082/stet/psd2/v1.6.2/accounts/038-CDV30319665743USD/overdrafts”},

“parent-list”: {“href”: “http://localhost:8082/stet/psd2/v1.6.2/accounts”}

}

}

(case of persona Adam – D0999994I0)

Error codes

Here is the list of error code descriptions for this service.

| Error | Description of error |

|---|---|

| AC01 (CFONB) | IncorrectAccountNumber: the account number is incorrect or unknown |

| AC04 (CFONB) | ClosedAccountNumber: the account is closed |

| AC06 (CFONB) | BlockedAccount: the account is blocked / subject to an objection |

| BE05 (CFONB) | UnrecognisedInitiatingParty: the AISP is unknown |

| BADS | BadScope: the call to the service was made with a CBPII token (AISP expected) |

| INTE | InternalError: there is an internal processing error |

| INTS | InternalServerError: there is an internal error communicating with the IS |

| IPGN | InvalidPageNumber: the page number is invalid |

| NGAC | NotGrantedAccount: the account is not granted |

| ISPM | NotImplemented: the wrong verb is called (GET expected) |

| TMRQ | TooManyRequest: the number of possible requests has been exceeded |

| IPSU | InvalidPSU: Subscriber number not listed or remote banking subscription cancelled |

| FF01 | Bad Request: the format of the request is incorrect |

| ENDE | EntriesDateError: incorrect date format |

| RENF | ReferenceNotFound: movement not referenced |

| NAAC | NotAvailableAccounts: absence of eligible accounts |

| CDNA | CardNotAvailable: the deferred debit card is not or no longer accessible |

Acceptance testing

The aim of these test cases is to enable you to carry out a minimum number of tests in order to get to grips with this API and access it from your application. They must be validated before the application is deployed in production.

| Test description | Data set and expected result |

|---|---|

Recovering an account balance ⇒ Check the links in the query result (self, balances and transactions links) | Persona: Marc – 038-CPT30019654051 Prerequisite: OAuth2 scope = aisp Result: HTTP 200 response ⇒ OK return of the three payment account balances |

Retrieve all account balances, with balances at 0 ⇒ Check the links in the query result (self, balances and transactions links) | Persona: Adam – 038-CPT30319665741 Prerequisite: OAuth2 scope = aisp Result: HTTP 200 response ⇒ OK return of the three payment account balances sales are at 0 |

| Recovering balances linked to an unknown account | Persona: Unknown – 038-CPT30014684067 Prerequisite: OAuth2 scope = aisp Result: HTTP 404 response ⇒ unknown account error message: AC01 |

| HTTP request with an unauthorised access token for the resource (incorrect scope) | Persona: Marc – 038-CPT30019654051 Prerequisite: OAuth2 scope = aisp Result: HTTP 403 response ⇒ access to the resource refused error message: BADS |

| Passing an HTTP POST request | Persona: Marc – 038-CPT30019654051 Prerequisite: OAuth2 scope = aisp Result: HTTP 405 response ⇒ unauthorised method |

Get transactions history

Principle

Get a history of future transactions and direct debits from a current account, or invoices for deferred debit cards linked to it.

Use cases

This service can be used to retrieve the list of transactions on a current account or the list of bills for a customer’s deferred debit card.

The transactions obtained are less than or equal to 90 days from today’s date. Direct debits due within 15 days are also returned.

Case of a current account (in EURO):

- The list returned can be paginated if there is a lot of data to display, in which case links to the first, previous, next and last pages will make it easier to consult the results.

Case of a currency account:

- There is no pagination support for transactions.

- For each transaction, information « bankTransactionCode » (in transactions on an account in EURO) are not provided (ex: {“domain”: “ACMT”, “family”: “MDOP”, “subFamily”: “OTHR”, “code”: “226”, “issuer”: “SI EQUINOXE”}).

This service follows on from the return of the list of a customer’s current accounts and deferred debit cards: a resourceId corresponding to an account or card must be supplied to obtain the list of transactions.

Access to this method is limited to a maximum of 4 batch accesses per calendar day, for a given customer and account/deferred debit card, excluding paging.

In short, this service allows you to list the transactions on a customer’s current account or to list the bills on a deferred debit card attached to that current account.

Prerequisites